Embedded SIM

Embedded SIM is an evolution of the physical subscriber identity module (SIM) cards familiar to mobile users since the dawn of GSM. While conventional SIM cards are replaceable, requiring users to swap in order to switch between service providers, Embedded SIM sees a fixed module integrated into the device, with over-the-air provisioning and updating used to enable switching, delivering more flexibility in choice of operator to the end user.

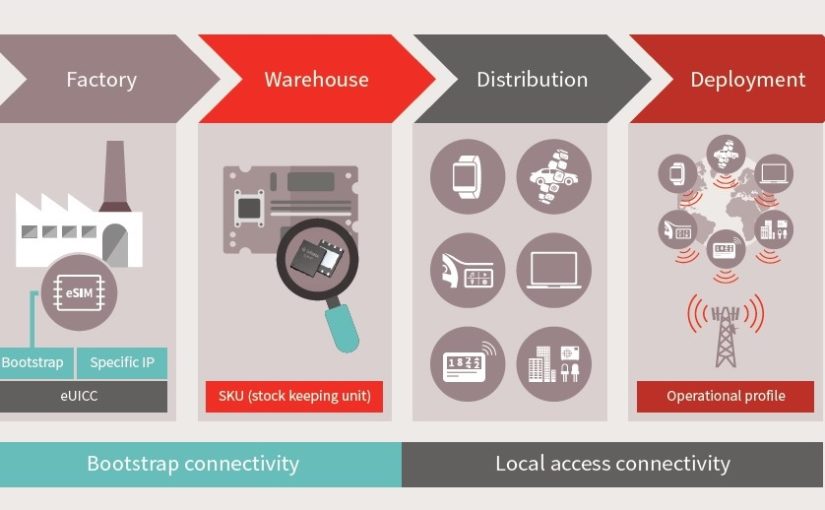

In the machine-to-machine (M2M) market, this approach can offer significant benefits, not least of which is the ability to more easily swap connectivity providers. Networks can be selected after the production, shipment and deployment of connected devices, thus bringing flexibility in choosing the best option for a destination country and taking into account factors including cost, coverage and regulatory requirements.

But as with any new technology, Embedded SIM brings with it challenges, particularly around interoperability and connectivity management. This includes complexities in managing Embedded SIM profiles across different MNOs, as well as with differing approaches taken by vendors in conforming to GSMA standards. While the flexibility and choice offered by Embedded SIM-enabled cellular IoT can deliver real benefits for enterprises, nevertheless managing multiple IT system interfaces (such as MNO connectivity and device management interfaces), contractual and billing relationships can be an unwelcome additional burden.

Market opportunity

According to GSMA Intelligence figures, at the end of 2018 there were more than 9 billion IoT connections (comprised of cellular and non-cellular technologies), with smart home use cases in the consumer space, and smart buildings and utilities in the enterprise market at the forefront.

This is just the tip of the iceberg: by 2025, this number will grow to more than 25 billion IoT connections, with the market opportunity across connectivity; applications and platforms; and professional services topping $1.1 trillion.

The increasing availability of cellular IoT networks means that technologies such as NB-IoT and LTE-M are set to grow their share of IoT connections, benefitting from the economies of scale and interoperability delivered by standards-based solutions.

As of April 2019, there were 110 commercial networks using these technologies, which deliver low power consumption while benefitting from broad geographic availability – key factors in enabling the adoption of cellular IoT (although it is worth noting NB-IoT does not currently offer roaming capabilities at present, making it less suited to the Embedded SIM business case).

Nevertheless, despite accelerating adoption of IoT and M2M, for the enterprises, which stand to benefit from the adoption of these applications, there are still significant challenges to resolve. For many, it will not be easy to address these issues on their own.

Tough choices

While cellular IoT offers clear advantages as the connectivity enabler for M2M, including cost effective, pervasive and secured connectivity, it also requires choices to be made which will impact the way a device is connected over a lifetime that could be measured in decades. For example, it can be difficult to select a particular MNO at the point of device or module manufacture, because at that stage it may not be known where or how the device will be

deployed or used.

Once in the field, it is difficult to change connectivity providers due to interoperability challenges associated with using multiple vendors and MNOs, for example related to network certification or integration with backend platforms. In addition, devices may be deployed in remote or hard-to-reach locations, posing a costly physical challenge to swap one SIM for another in the event of changing connectivity provider.

Add in the need to comply with regional or national regulatory frameworks, which may impose limitations regarding permanent roaming that effectively mandate the use of a local MNO, and it becomes a significant undertaking to design-in connectivity at manufacture.

While Embedded SIM provides the potential to ease some of the pain-points associated with deploying and managing cellular IoT at scale, it brings some challenges of its own. It can be difficult to provide a consistent user experience in an environment where multiple service providers may provide connectivity, and companies offering services which cross borders require systems which will work across countries and regulatory environments.

A good example is a logistics company, which needs consistent information on the location and condition of its goods, regardless of where those products are currently. It this case, multiple service providers will be called upon to deliver connectivity to the devices handling tracking, and an Embedded SIM would be required to switch seamlessly between MNOs and be capable of roaming onto partner networks to maintain monitoring.

The same challenges arise in industries such as commercial vehicle fleet management. Research company, Berg Insight, said there were 7.7 million active fleet management systems deployed in Europe alone at end-2017; and, it predicts the number will hit 15.6 million by 2022, representing a potentially huge number of connected IoT devices.

And these are just two examples of vertical markets requiring broad IoT connectivity. Other potential sectors include automotive, healthcare; retail; and smart homes, smart buildings and smart city applications.

Implementation challenges

Although Embedded SIM is a standardized technology, a number of issues associated with deployment remain – not least of which is convincing MNOs to implement solutions based on the specifications. Around a decade of development lies behind today’s Embedded SIM standards. This creates a challenge for MNOs who may be unconvinced by the benefits offered for their own business, let alone for enterprise customers operating across diverse vertical markets.

Expertise in managing Embedded SIM may be lacking. While traditional SIMs have typically been configured for a specific terminal, be it a mobile phone or IoT device, MNOs may need to update their systems to enable them to handle a broad range of devices regardless of form factor, to deliver the equivalent level of security and authenticated access to mobile networks provided by traditional SIMs. Deploying Embedded SIM can also necessitate a rethink of MNO business models, for example in markets where MNOs subsidise devices locked to their network.

Another factor to consider is the impact Embedded SIM may have on module manufacturers. As the industry moves away from a model where SIMs are produced for specific MNOs, the manufacturing business model will also change: It is not unreasonable to expect some consolidation in the sector as a result.

Born connected

There are numerous challenges associated with deploying and using Embedded SIM, despite the clear advantages it offers over the traditional SIM-base approach. Fortunately, leading companies are working on solutions to these challenges, in a bid to enable the true potential of Embedded SIM for MNOs and enterprises alike.

The approach aims to marry the key benefits of Embedded SIM with a set of supporting technologies to address the key pain-points associated with deploying at scale. It combines Embedded SIM with connectivity to offer customers the ability to deploy cellular IoT enabled devices without encountering the restricting factors that have impeded adoption.

This joint solution can be applied to a broad range of devices, addressing connectivity challenges associated with automated subscription and device provisioning; authentication; and device-specific deployments. The goal of removing complexities is to enable customers to focus on the benefits cellular IoT connectivity has to offer, rather than spending time and money working to resolve compatibility issues, or having to make tough choices at the design stage.

Deployment benefits

Offering a pre-integrated approach to connectivity has the potential to enable equipment manufacturers to deliver products capable of worldwide use, rather than needing to deliver specific versions for specific markets. This offers obvious economies of scale, and cuts costs through simplified product management, with a need for fewer versions of products (stock keeping units, or SKUs).

With the ability to deploy globally, manufactures can deliver modules for multiple devices regardless of form factor or end-use, opening up the full range of vertical market opportunities, in the knowledge that integration of cellular IoT will not be the major challenge.

The availability of a pre-integrated set of best-of-breed technologies means a significant portion of the heavy lifting for cellular IoT adoption is taken out of the equation, enabling manufacturers to quickly adopt the technology and reap the rewards. When combined with flexible service assurance, this pre-integrated approach holds the potential to improve time-to-market for customers, while also keeping research and development costs under control.

And in an alternative chain involving hardware manufacturers, Embedded SIM vendors, integrators and connectivity providers, each party is looking to make a profit on their slice of the deal as well as other components built into their solution, meaning multiple levels of margin stacking and ultimately inflated prices. This additional cost is taken out by an integrated offering, delivering a significant benefit for customers looking to embrace cellular based IoT.