Executive Summary Less than 5% of commercial buildings have In-Building Wireless (IBW) solution installation. Without In-Building wireless installation, property managers,…

Enterprise relationship with MNO is not always a smooth experience despite best effort of MNO and Enterprise to make this…

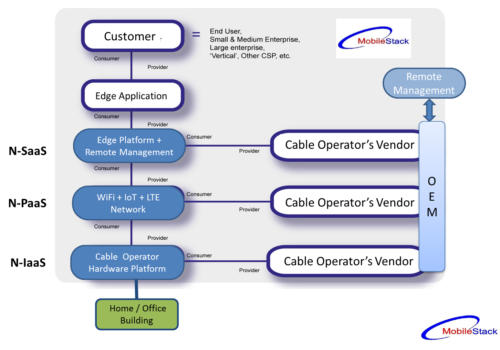

After Verizon launch of 5G Home Connect product, Cable Industry has come under direct competition in their monopolistic ISP market…

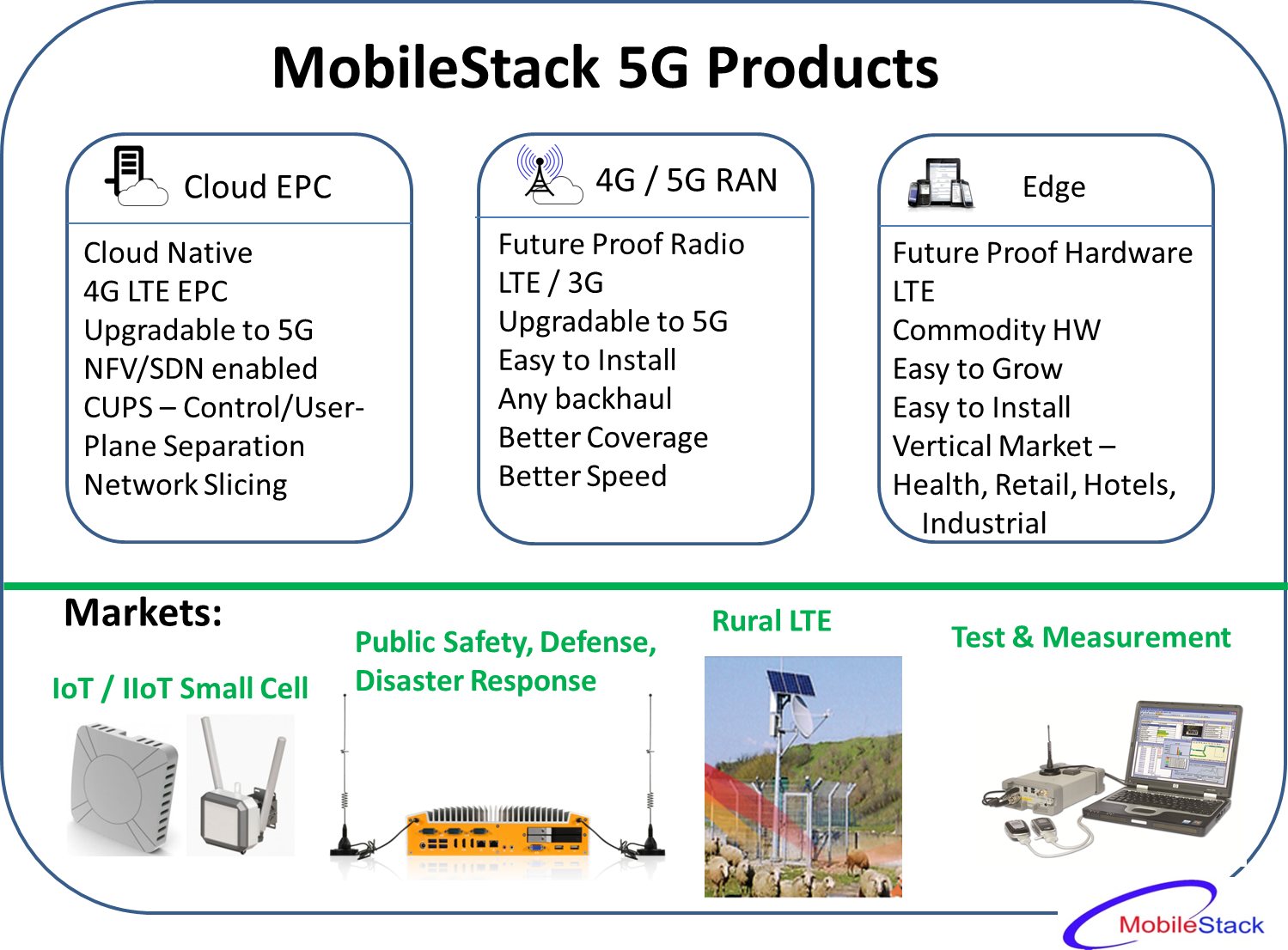

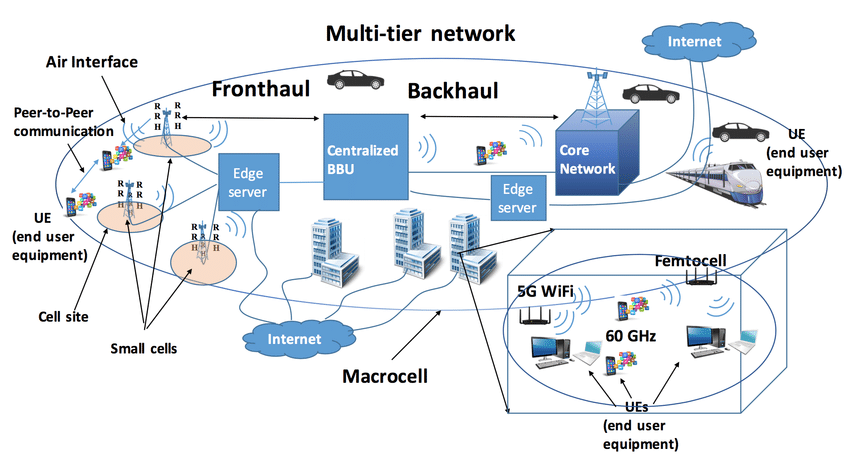

Mobilestack 5G Products using future-proof Hardware Introduction Future Proof 5G products are needed to reduce network cost with faster upgradability. …

5G race has already started. There is talk of USA vs Pacific (China / Japan / S. Korea) competition for…

Adding LTE to a Wearable is not as easy as adding Bluetooth to a Wearable. Mobilestack Inc has deep experience…